Schuff Steel Company recognizes the importance of staying current with trends that affect business and the industry as a whole. Since 1976, we have prided ourselves on maintaining intimate knowledge of where the steel industry is headed. This practice, along with a forward thinking and an open mindset has supported our lead in complex structural steel development.

We share these insights quarterly. Stay connected by opting into the Schuff Steel Quarterly newsletter at the bottom of this page.

Economic outlook

- March 8: 25% Section 232 tariffs of the Trade Expansion Act were announced on all countries except EU, Canada, Mexico, South Korea, Argentina, Australia and Brazil

- April 30: Korean Quota agreement was reached that exempt South Korea from tariffs in exchange for Quota on imports

- May 31: Section 232 tariffs were finalized to include Europe, Canada and Mexico

- June 15: The Section 301 trade action against China was finalized for part 1 of the investigation. An additional tariff of 25% was imposed on Chinese raw steel products, as well as 818 other items totalling $34 billion in product

- Part 2 of the Section 301 trade action was also announced, to include an additional $16 billion in various products. The second list includes all products under Harmonized Tariff Codes 7308 – iron and steel bridges, structures and structure parts.

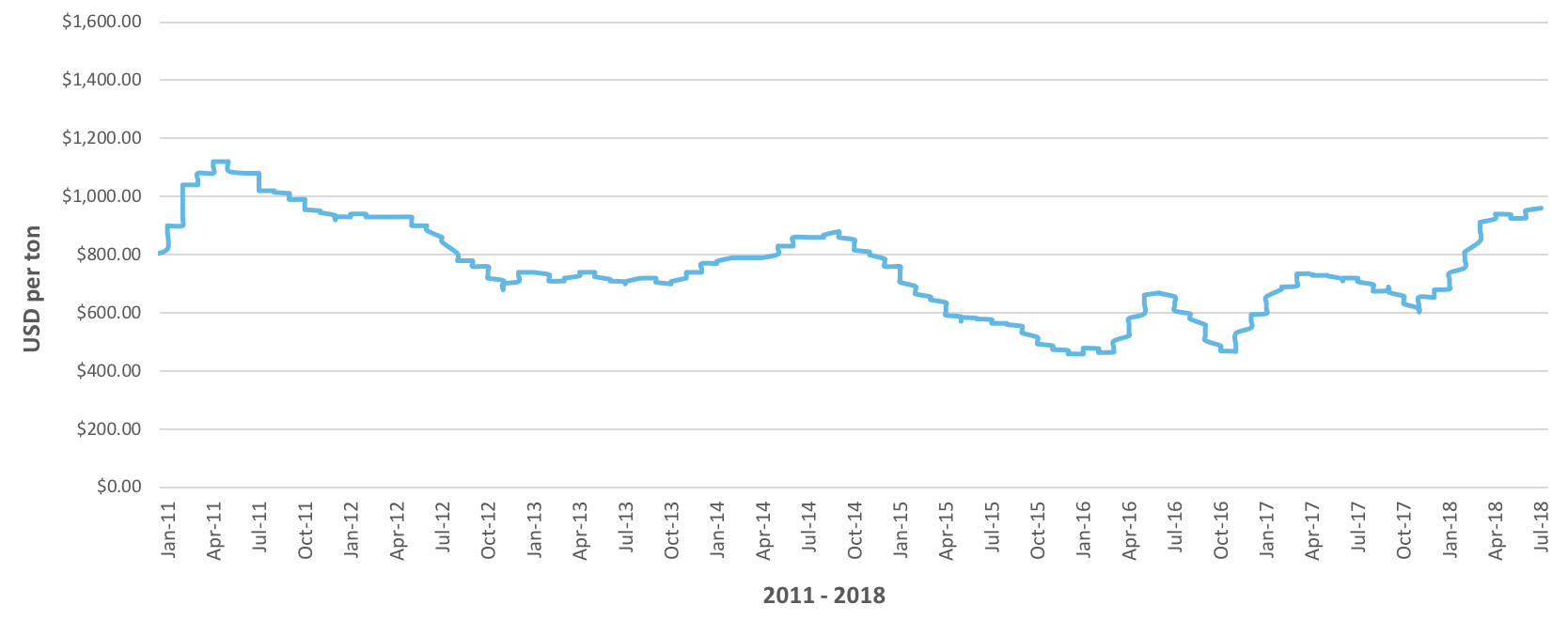

Material pricing increases over the last quarter

- HSS increased $100.00 per ton

- Merchants increased $65.00 per ton

- Beams increased $65.00 per ton

- H-piling increased $45.00 per ton

- Sheet-piling increased $150.00 per ton

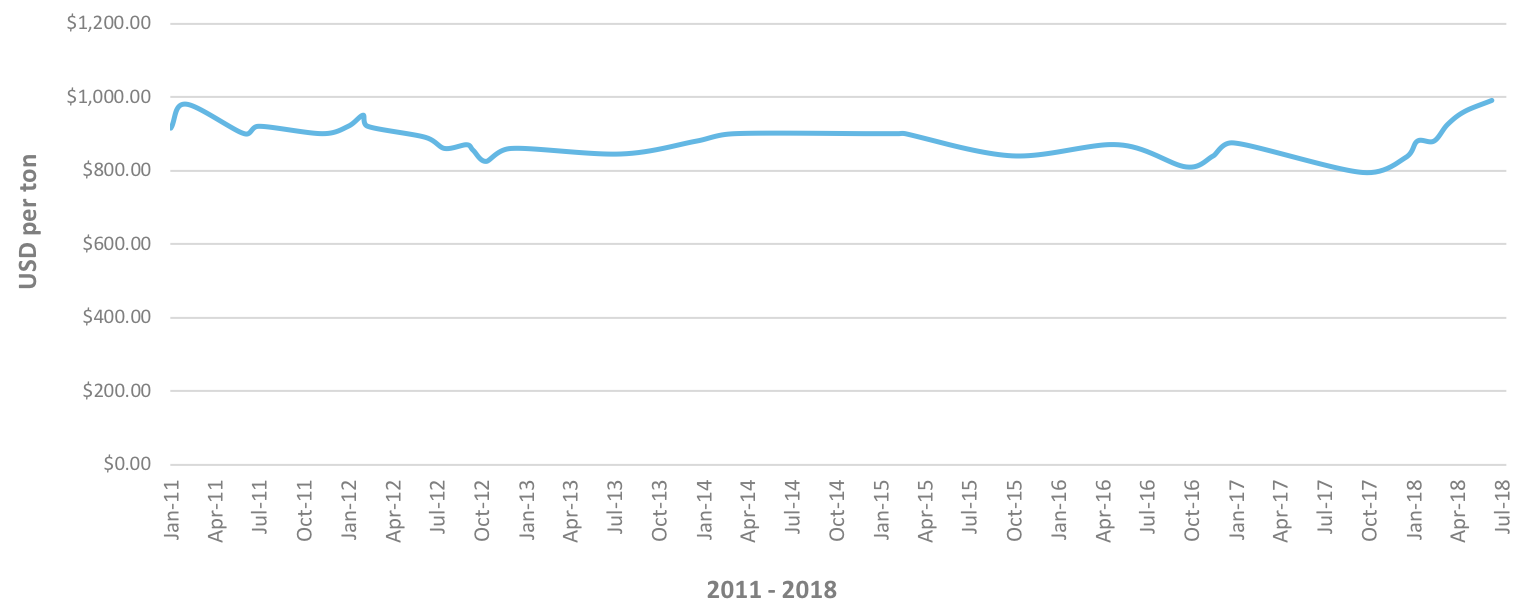

Flange beams

Cut plate