Schuff Steel Company recognizes the importance of staying current with trends that affect business and the industry as a whole. Since 1976, we have prided ourselves on maintaining intimate knowledge of where the steel industry is headed. This practice, along with a forward thinking and an open mindset has supported our lead in complex structural steel development.

We share these insights quarterly. Stay connected by opting into the Schuff Steel Quarterly newsletter at the bottom of this page.

Economic outlook

- GDP: Has grown by 2.5% in 2019, compared to 2.9% growth in 2018.1

- Unemployment: Job gains will be around 180,000 per month in 2019.1

- Energy: Crude trading increased from $55 to $60 per barrel in June.1

- Housing: There have been 5.35 million existing-home sales in 2019, down 0.4%.1

- For the 64 countries reporting to the World Steel Association crude steel production increased by 4.1% in February 2019 compared to 2018 equaling 137.3 million tons.1

- The US produced 6.9 million tons of crude steel in February 2019, a 4.6% increase compared to February 2018.1

- The adjusted year-to-date U.S. steel production through April 6, 2019 was 26,136,000 net tons, at a capability utilization rate of 81.9%. Production is up 6.8% from the 24,472,000 net tons during the same period last year, when the capability utilization rate was 76.5%.1

- In July 2019, the US Mills capacity utilization rate was 79.4%.2

- The US Department of Commerce has set preliminary duties on fabricated structural steel shipped from China into the US (177%) and Mexico at 74%.2

- HR lead time sits at 3-6 weeks, while CR lead time is 4-7 weeks.2

- Zinc costs were $1.08lb in July 2019.2

Material pricing changes over the last quarter

- Hot rolled coil prices have bottomed out and are now rising. The mills raised prices officially $40 per ton on June 25 and $40 per ton on July 9. While they have not realized the full increase, unofficially the mills are realizing an increase of $40-$60 per ton. These increase notices have been able to stop the downward spiral in pricing.

- Hollow structural shapes have followed coil price increases officially rising $80 per ton, though the realized increases are much lower than that.

- Plate pricing continues to slide with bottom end pricing likely very close. Plate prices are expected to increase at the end of summer.

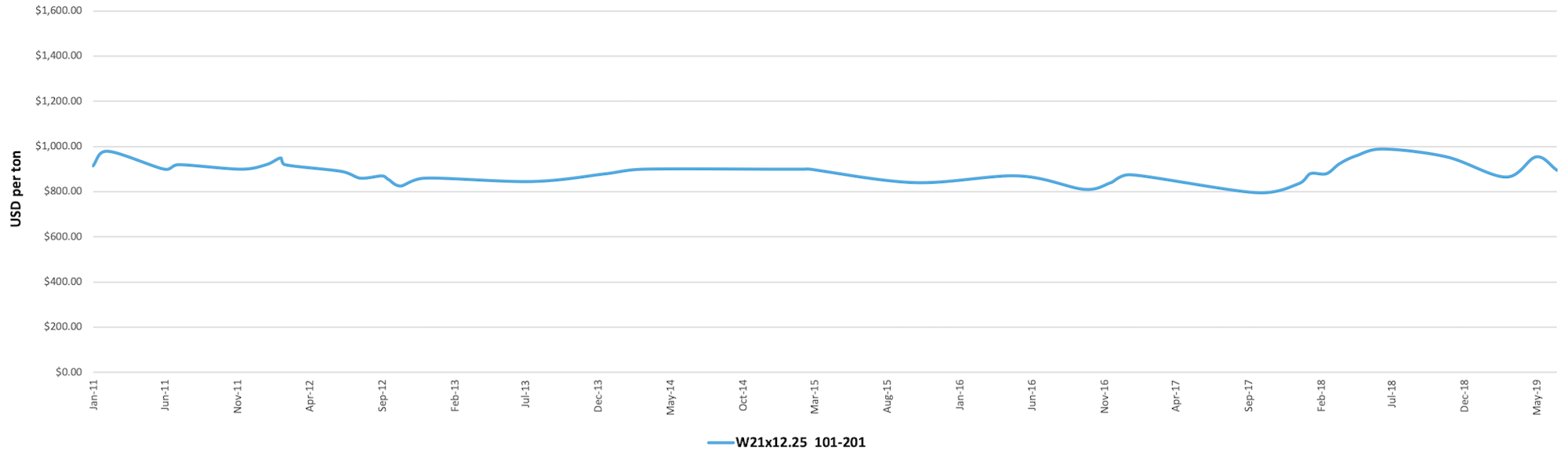

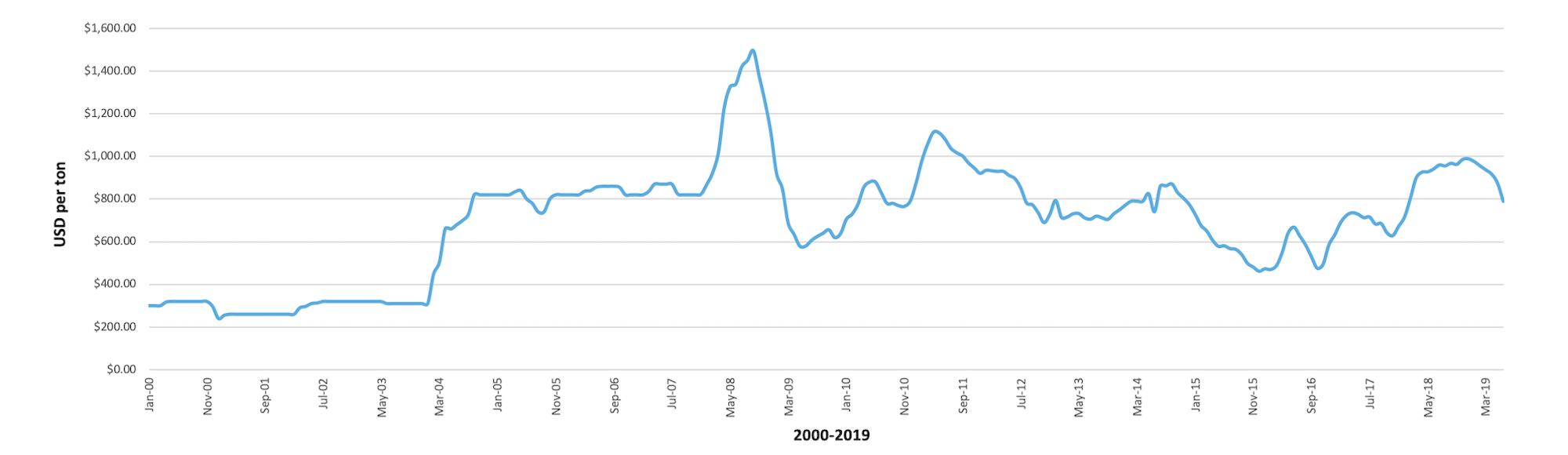

- Beam and merchant prices dropped $60 per ton and $40 per ton consecutively on June 13.

- Scrap supply is starting to get tight, and prices are expected to increase in August.

- The mills are protecting jobs for 6 months to 12 months with all indications that prices will go down again this year.

Flange Beams

Cut Plate

References:

1. Nucor. Steel Industry Barometer. PDF file. April 2019

2. Zekelman Industries. (July 2019). Steel Snapshot.