Each quarter we share our internal Supply Chain Report where we profile a key indicator that influences the economy and construction in terms of pricing, capacity and consumption. Below are indicators we have shared in the past.

Q2 2023

Q2 2022

Q4 2021

Q3 2021

Q2 2021

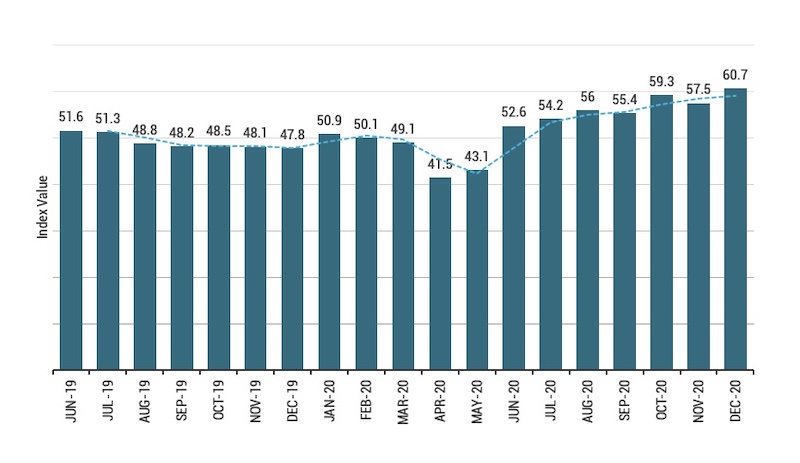

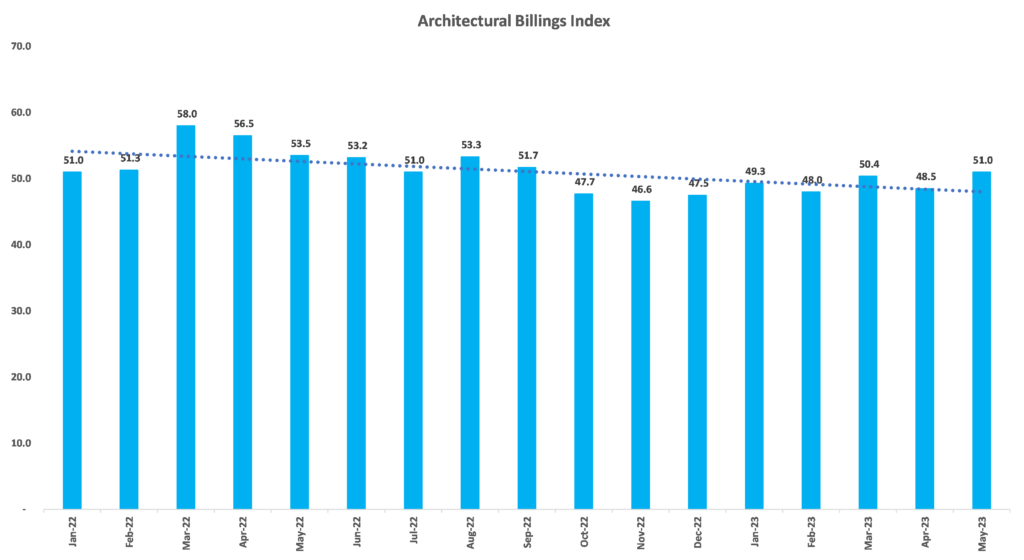

Architecture Billings Index (ABI)

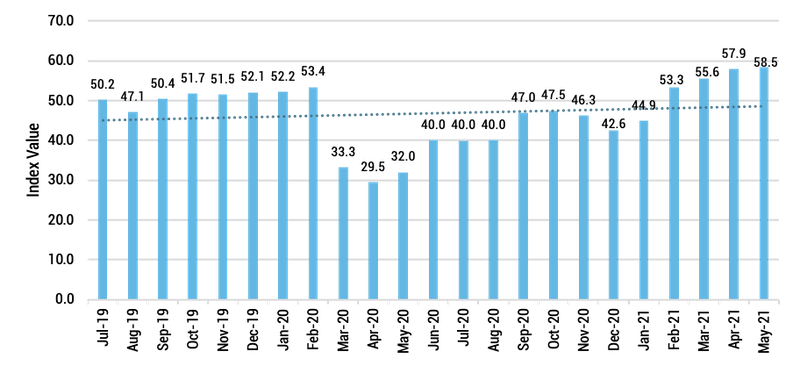

The Architecture Billings Index (ABI) tracks survey data on billings from leading architectural firms to forecast upcoming non-residential construction. Billings are sorted by region – West, South, Midwest and Northeast – to show most active areas. The ABI report also provides indications of price changes for construction materials in its verbiage section.

How to use it:

Architectural projects consume 44% of all steel in the US, which translates to upcoming steel demand as construction jobs generally begin 9-12 months after architectural work is engaged. We use the ABI to help us evaluate future supply needs. Any reading of 50 or greater on the ABI reflects increases in firm billings and is expected to translate into future construction growth.

Exceptions such as unusual financial events or when a firm may do the architectural work but not build the project as planned, can occur from time to time, however overall the ABI is a trusted indicator of future construction work.

Q1 2021

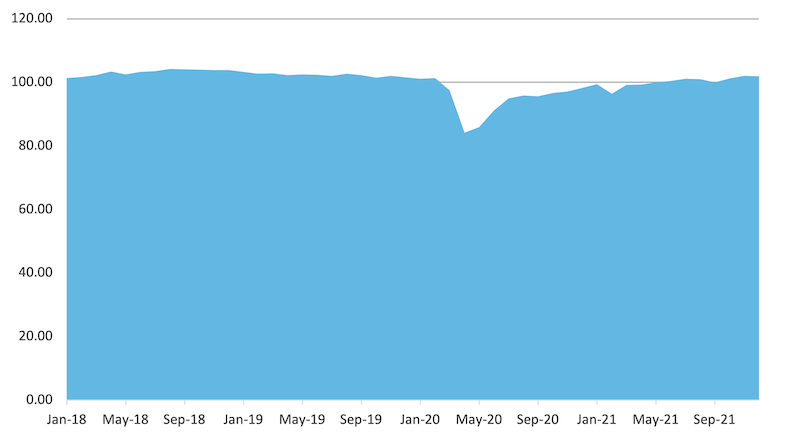

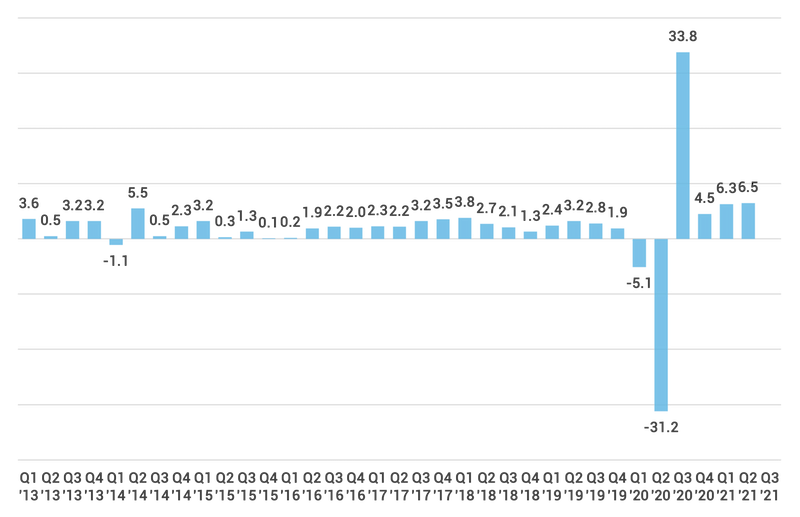

PMI Index

Issued by the Institute for Supply Management, these reports measure economic change month to month to illustrates trends in the industry. The data comes from monthly surveys submitted by purchasing managers in specific fields.

The PMI measures and tracks trends for the five following categories:

1. New orders from customers

2. Lead time for deliveries – how quickly orders are shipped

3. Inventory levels at participants

4. Production levels and back logs

5. Employment rates within industries

How we use it:

We specifically review markets that we think will impact prices and availability of steel products, such as the manufacturing PMI which best reflects steel demand.

Any PMI index level of greater than 50 equates to expansion in that market, any PMI level of 50 equates to no change in that market and any PMI index level of below 50 equates to contraction in that market.

This information helps us better understand the fluctuations in supply and demand, as well as relevant history to predict how pricing will change based on lead times, supply problems and demand trends.